Due diligence

Ceres is your trusted partner for due diligence

Ceres Waste, Renewables & Environment (Ceres WRE) is recognised as a specialist due diligence provider for investors, lenders, and developers in the waste, recycling, and renewable sectors.

Our Director-led approach ensures every assessment is informed by decades of senior-level experience and a proven track record in major UK and international transactions. We combine technical, commercial, and regulatory insight to deliver robust evaluations of feedstock security, operational performance, compliance risks, and market dynamics—helping clients make confident, informed decisions and mitigate investment risk.

We support vendors and investors at all stages of a process:

Pre-deal - market evaluation and business case development, target identification and screening, technology searches and reviews, vendor due-diligence, and investor briefings and workshops.

Transaction support - commercial due diligence (reg flag and detailed due diligence), high-level technical due diligence for anaerobic digestion, ‘value add’ and opportunity assessment.

Post deal - feedstock and output auditing, contract support, investment optimisation and growth strategy, vendor business case development and implementation.

The scope of our feedstock expertise:

Waste treatment technology is becoming more complex as we push to recover more value from residual waste, recyclables and biogenic wastes. In turn, this is making the procurement of feedstocks and offtakes more complex as more advanced technologies demand more refined and specialist solutions.

In addition to our long track record of supporting energy from waste, anaerobic digestion and conventional sorting and treatment infrastructure, Ceres WRE understands the critical success factors of chemical recycling and other ‘waste to molecule’ technologies that will be increasingly supported by policy changes and incentives as carbon reduction comes to the forefront.

Whether you are a project developer seeking investment, or an investor considering these technologies as part of your portfolio, Ceres Waste, Renewables & Environment can offer you support from a team with personal experience.

Understanding technology, markets and value chains

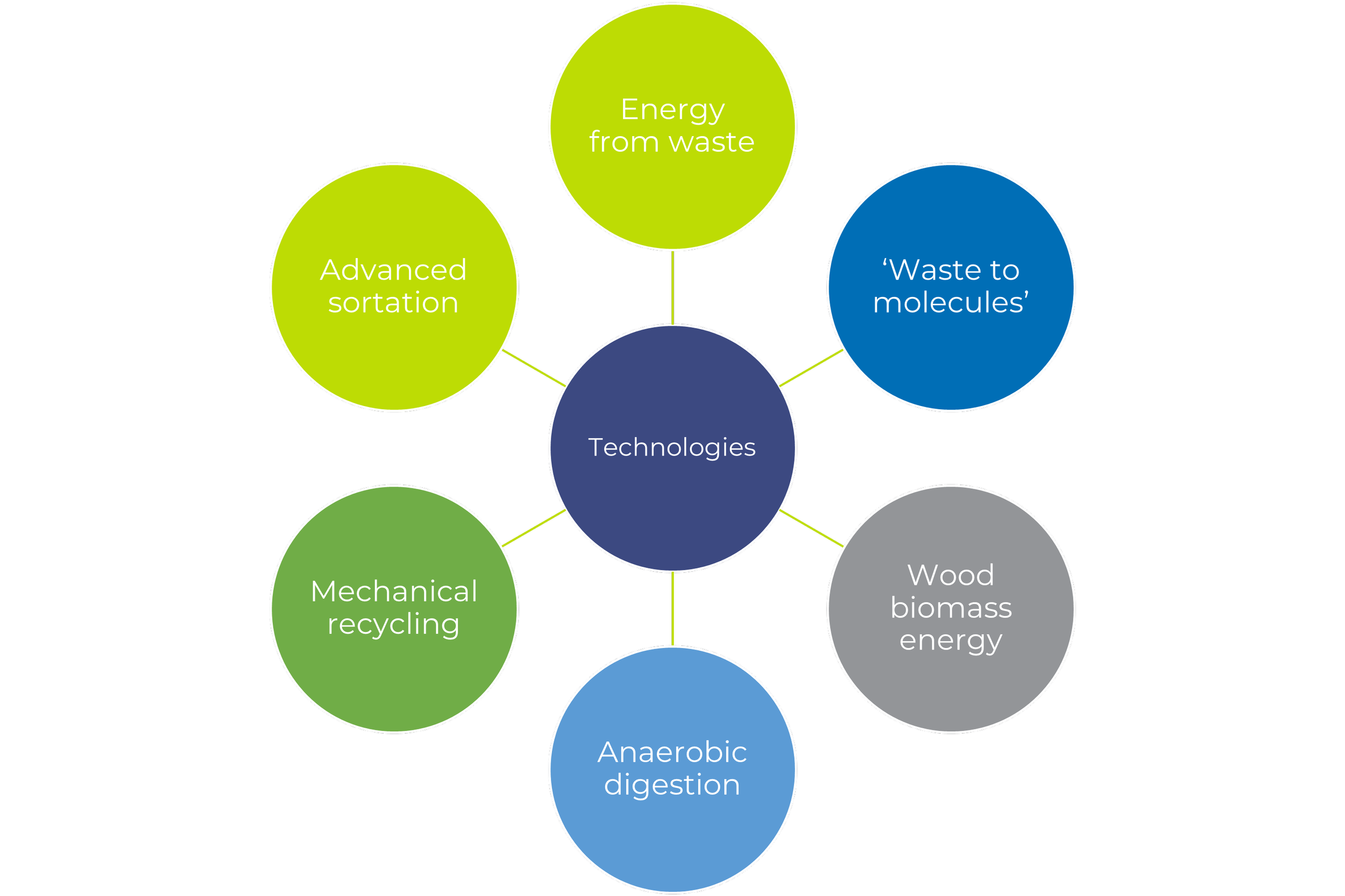

Technologies we cover:

Client testimonial

“Equitix has worked with Ceres and its Directors for several years across various energy from waste and bioenergy projects . They are a trusted advisor in helping us understand the markets in which we invest and seek project optimisations”

— Egan Archer, Managing Director, Asset Management

Venture and early stage due diligence

At Ceres WRE, we deliver concise, high-level due diligence reports tailored for venture capital and impact investors evaluating start-ups, innovation-driven businesses, and early-stage technologies.

Our reports provide actionable insights across critical areas:

Market & competitive analysis – understand industry trends, market size, and competitor positioning

Business case & commercial evaluation – assess revenue potential, scalability, and strategic fit

Technical feasibility reviews – validate technology readiness and innovation viability

ESG & Sustainability Impact Assessments – Evaluate environmental, social, and governance factors, including carbon footprint and water impact

Leveraging deep sector expertise, we support deal teams and investment committees in identifying high-potential targets and making informed decisions. Our focus includes:

Circular economy & material flow Innovations

Waste to molecules

Energy transition technologies

Disruptive business models & start-ups

Partner with us to de-risk early-stage investments and accelerate your portfolio’s impact.

We deliver detailed commercial and technical assessments for a wide range of waste sorting, recycling, degradation, and renewable energy technologies. Our services support pre-deal market analysis, mergers and acquisitions (M&A), and strategic investment decisions.

Our expertise includes:

Advanced sorting and separation technologies

Plastic recycling and key material recovery solutions

Composting and anaerobic digestion processes

Energy from waste and ‘Waste-to-X’ projects including sustainable aviation fuel (SAF) and other renewable molecules.

Combustion, pyrolysis and gasification technologies

Using our extensive sector experience, we provide technology options tailored to specific applications, markets, and waste-derived outputs. From initial market analysis through to transaction support and final deal execution, we assist international vendors and buyers with:

Commercial & technical advisory services

Due diligence documentation

Independent, ad-hoc support for client teams and advisors

Partner with us to de-risk investments and accelerate growth in circular economy, energy transition, and sustainable waste management technologies.

Market analysis, technology and plant portfolio evaluation

Technical and Commercial

Due Diligence for investors

Ceres WRE provides both red flag reviews and detailed due diligence assessments for:

Competitive transactions and acquisitions

New infrastructure developments

Our expertise ensures that risks are identified early and opportunities are maximised.

We specialise in the review and evaluation of business strategies and operational plans for the development of new waste facilities and infrastructure. Our focus includes:

Commercial assessment and evolution of feedstock and offtake markets in response to policy and other drivers

Technology selection for waste processing and recycling

Carbon reduction and alignment with sustainability goals

We have proven experience in waste infrastructure strategy

Expertise in circular economy principles and green energy transition

Tailored solutions for investors, developers, and operators

Vendor due diligence

At Ceres Waste, Renewables & Environment, we provide independent vendor due diligence reports that are trusted and well-received by investors. Our reports give stakeholders the confidence they need to make informed decisions, ensuring transparency and reducing risk in complex transactions.

We have extensive experience producing due diligence reports for innovative technologies, including:

Conventional EfW

Biomass energy & anaerobic digestion

Chemical recycling

Waste-to-molecule solutions

Advanced waste-to-energy and waste-to-X projects

Our team understands the unique technical and commercial considerations of these emerging sectors, helping investors evaluate feasibility and performance with confidence.

What sets up apart?

Investor-focused insights -We know what information investors need to assess risk and opportunity.

Proven track record - Our reports have supported successful transactions and acquisitions across the waste and renewables sector.

Comprehensive approach -We combine market analysis, technical evaluation, and regulatory context to deliver actionable insights.

Selected track record